To plan for a comfortable retirement in South Africa, start early by assessing financial health, consistently contribute to tax-efficient funds like pension plans or annuities, diversify investments across asset classes, seek personalized guidance from a financial advisor, and regularly review & adjust your strategy. Regular reviews ensure your savings align with goals, manage inflation, and consider changing life circumstances for peace of mind.

Planning for a comfortable retirement in South Africa requires understanding the unique landscape of retirement savings. This comprehensive guide delves into the essential strategies and expert advice needed to maximize your retirement income. From navigating tax-efficient investment options to creating a sustainable financial plan, these practical tips will equip you to secure your future. Discover how to make the most of your savings, ensuring financial stability and peace of mind as you age.

- Understanding Retirement Planning in South Africa: A Comprehensive Guide

- Strategies to Boost Your Retirement Savings: Practical Tips and Tricks

- Creating a Sustainable Retirement Income Plan: Expert Advice for Longevity

Understanding Retirement Planning in South Africa: A Comprehensive Guide

Planning for retirement in South Africa involves understanding various factors that will impact your future financial security. It’s essential to start early, as time is one of your most valuable assets. The first step is assessing your current financial situation: income, expenses, and existing savings. From there, you can begin to contribute consistently to retirement funds, taking advantage of tax-efficient options like pension funds or retirement annuities. Diversifying investments is also key; spreading your portfolio across different asset classes ensures risk management while maximizing potential returns.

Consider working with a financial advisor who can guide you through the process. They can help tailor a plan that aligns with your goals, risk tolerance, and time horizon. Regularly reviewing and adjusting your strategy as life events unfold is crucial. This might include changes in income, family circumstances, or market fluctuations. By proactively planning and making informed decisions, you’ll be better equipped to enjoy a comfortable retirement in South Africa.

Strategies to Boost Your Retirement Savings: Practical Tips and Tricks

Planning for a comfortable retirement in South Africa requires a strategic approach and discipline. One effective strategy is to start early by opening a retirement savings account, such as a R2000 monthly contribution into a provident fund or an old-order pension fund. This not only allows for compound interest but also provides tax benefits.

Diversifying your investment portfolio is another crucial trick. Consider allocating funds across various asset classes like stocks, bonds, and property to spread risk. Regularly reviewing and adjusting your investments based on market trends and personal financial goals will ensure your retirement savings keep pace with inflation. Additionally, exploring tax-efficient savings options, such as tax-free savings accounts, can significantly boost your retirement funds.

Creating a Sustainable Retirement Income Plan: Expert Advice for Longevity

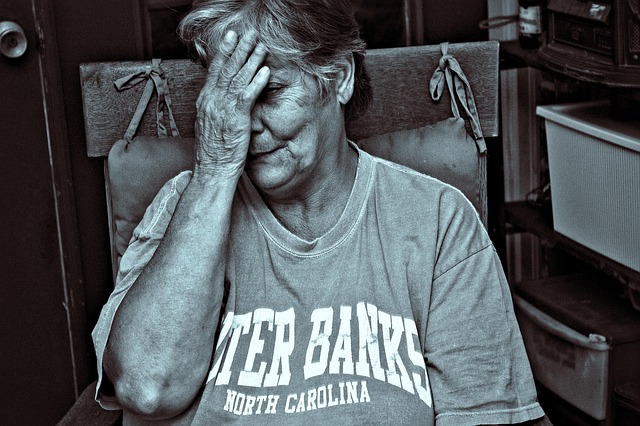

Planning for a comfortable retirement is essential for ensuring financial security and independence in your golden years. In South Africa, where longevity is increasing, creating a sustainable retirement income plan becomes even more vital. The first step is to assess your current financial situation and future goals. Consider factors like your expected retirement age, desired lifestyle, and potential healthcare costs, which can vary greatly with age.

Experts recommend starting early and being consistent with savings. Utilise tax-efficient retirement savings vehicles like pension funds or retirement annuities. Diversifying investments within these vehicles can help manage risk. Additionally, regular reviews of your plan are crucial as life circumstances change; this ensures your strategy remains aligned with your goals, offering peace of mind and the opportunity to enjoy a comfortable retirement.

Planning for a comfortable retirement in South Africa involves understanding local regulations, employing strategic savings methods, and creating a sustainable income plan. By implementing these practices, you can maximize your retirement savings, ensuring financial security and peace of mind as you age. Remember, it’s never too early to start preparing, and with the right approach, you can enjoy a rewarding retirement in this beautiful country.